Stash App | Is this Investment App Legit or Scam?

The Stash App is essentially a budgeting app that comes wrapped up in what’s claimed to be an investment. The platform was designed with beginner investors in mind, with the objective being to help them venture into stock buying and other investment vehicles with ease.

We are all looking for legitimate ways to invest our extra savings. More often than not, the goal is to sow with the hope of harvesting in the long haul. However, not all investments come out as successful ventures, and there are numerous factors that determine the success of an investment.

One of those factors is the investment platform that you choose to engage. Today, there are thousands of online platforms that claim to walk beginner investors through the journey of profit generation. But unfortunately, not all investment programs are legit. There is a host of online scammers that have been ripping off novice investors in the name of investment management.

If you are reading this review, it is obviously because you are considering signing up with Stash, and you want to find out whether it is legit or really a scam. You want to be sure that you can trust the platform with your money. Lucky for you, LegitWorkOnlineForReal is committed to scrutinizing such online platforms, to figure out whether they are exactly what they claim to be.

In this Stash review, we are going to cover everything you need to know about the Stash app. We will focus on the following areas:

- When was it Started?

- What is the App All About?

- What Does it Cost to Use Stash?

- What Investment Options Does Stash Offer?

- How Much Money Can You Make with Stash?

- Good vs. Bad Qualities

- What We Liked About Stash App

- Stash User Reviews and Complaints

When Was Stash Started?

According to the Stash “About Us” page, the company was co-founded in 2015 by Ed Robinson and Brandon Krieg. The two co-founders have a history in Wall Street, where they spent years mastering the system of wealth creation through investment picking and management.

What Is The Stash App All About?

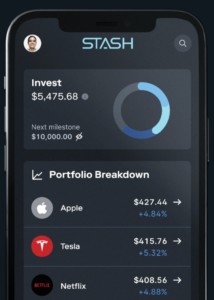

Stash Financial Inc. (often referred to as Stash), is a financial service firm based in New York city. The company runs both a web platform and mobile app, that allow users to invest there money in small incremental amounts.

The founders also seem to admit the system is often stacked against the everyday American. The Stash About Us page, also states that Krieg and Robinson left their Wall Street jobs with a single mission: making investing affordable and easy for everyone, eliminating the complexity of Wall Street.

Today, about seven years later, Stash boasts over six million users who have created and continue to create a secure financial future for themselves using the program. But how true are these claims? We will pursue the answer to this question together in the sections that follow.

How Much Does It Cost to Use Stash?

Stash employs a monthly subscription model with fees ranging between $1 and $9. There are currently three subscription pricing options with flat-fee offerings:

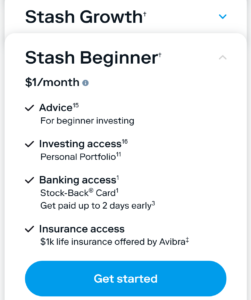

Beginner: $1/month – This subscription plan offers a basic brokerage account with a Stash Banking account. It also comes with free financial guidance and access to Avibra life insurance, up to the tune of $1000.

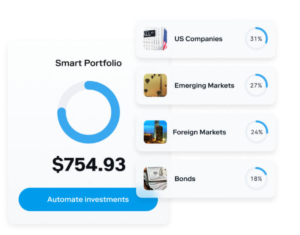

Growth: $3/month – This plan comes with everything in the beginners plan, plus retirement investment options. You will also be able to set up smart portfolios.

Stash+: $9/month – This is the most advanced subscription plan and the most ideal for families looking to save and invest. With Stash+, you will get two custodial investment accounts for your kids. In addition, you will also get 2X stock with the Stock-Back® Card, and access to life insurance of up to $10,000.

What Investment Options Does Stash Offer?

The Stash app offers access to the following investment options:

Stocks: You can browse through a wide range of categorized stocks across different industries. The best thing about Stash, is that investors can buy fractional shares for amounts as small as $1.

Funds: With the Stash App, you will have an opportunity to invest in short and long-term government bonds from the US and foreign governments.

ETFs: You can also have your money invested in ETFs organized by industry, cause, and theme.

Crypto Trusts: For those interested in cryptocurrencies such as Ethereum and Bitcoin, you can use Stash’s Smart Portfolios to profit from price action.

While these options are ideal for beginner traders, they fall short for sophisticated investors. If you are already an experienced trader, you should consider checking out alternatives with more complex investment products.

How Much Money Can You Make with Stash?

The amount of money that you can make using the Stock App, is entirely dependent on your choices. That means the subscription plan you buy, the type of investments you pick, and how you manage your portfolio.

To put it in simpler terms, you will only make money if you choose the right investments – successful investments. There are numerous investment options as discussed above, and with effective research, you can find winning investments across different industries.

You should also understand that financial investments have an inherent element of risk. The better you can manage these risks, the better your chances of becoming a successful investor. But there are no guarantees that you’ll make money using this Stash App.

Your investments can gain or lose value over time, depending on different market factors. However, Stash claims that successful users save an average of $1,432 per year. If you were to invest this money in a tax-deferred account and the investment earned a 7% annual return for 30 years, you could end up with circa $135,000.

The company also indicates that investors that succeed are those that use the different company tools. If this does not sound like something that interests you, you can try out other legit work online opportunities.

Good vs. Bad Qualities

Below are the pros and cons of having an account with the Stash App:

Pros:

- Allows you to buy fractional shares

- Automatic investing and saving tools

- Low minimum investment requirements

- Offers educational content

- You can earn bonus stocks via debit card purchases

Cons:

- Lacks wealth management services

- The monthly fees for premium plans are relatively high

- Higher expense ratios on ETFs

- the app does not offer financial advisor support

- Has a poor BBB rating of an “F”

What We Liked About Stash App

-

Cares About Investors’ safety and security

The app applies the following security protocols

- Two-factor authentication

- Biometric entry (Face recognition and fingerprint scans)

- 256-bit data encryption

- Coverage by the Securities Investor Protection Corporation (SIPC) and the Federal Deposit Insurance Corporation (FDIC)

- Debit Card locking and unlocking

-

Dedicated Customer Support Services

Stash offers customer support from Monday 8:30 am to Friday 6:30 pm through the following channels:

- Phone line

- Live chat

- Social media

- An informative FAQ page

However, you should know that the app does not offer financial advisor support.

Stash User Reviews and Complaints

Stash has been receiving a mixture of positive and negative reviews from users and it’s Better Business Bureau (BBB) page is a far cry from being flattering. As of this writing, Stash has an F rating on BBB for failure to respond to over 40 complaints.

Users have rated Stash an average of 1.34 out of the possible 5 stars, based on a total of 145 reviews. On Trustpilot, the app has a 1.9-star staring based on 608 reviews. The reviews that customers have been leaving are not looking good. However, no one has lounged any complaints with the Consumer Financial Protection Bureau.

Click Here, to read more real user experiences!!

Our Conclusion For The Stash App

From what we have uncovered, Stash is a viable legit option for beginner investors interested in investment funds, stocks, and ETFs. The app’s Smart Portfolio grants investors access to crypto through cryptocurrency trusts. We will also give Stash App credit for it’s Stock-Back® rewards, which is a program that offers investors bonus stocks for hitting qualifying purchases.

In summary, Stash is a legit beginner-oriented brokerage ideal for novice traders, but not suitable for advanced and sophisticated investors. The app does not offer future, options, and forex. It also lacks advanced research software and market reports are only accessible to Stash+ members.

As we conclude this article, we’re hoping that this review has been helpful. If you have used Stash before, let us know about your experience in our comment section below. Thank you for reading our review and feel free to leave a comment. We wish you all the best, as you pursue your journey as an investor.

Were you looking for our top, legit work online recommendation instead?

Click here To Read Our # 1 Recommendation!

Also, if you enjoyed reading and educating yourself with our “Stash App” review, please don’t limit yourself. Feel free to read and learn all about a different, legit online opportunity like:

OneSpace Freelancer (Legit) Review

Shutterstock Contributor (Legit) Review

And So Much More..